Page 1

LILAC Document Help

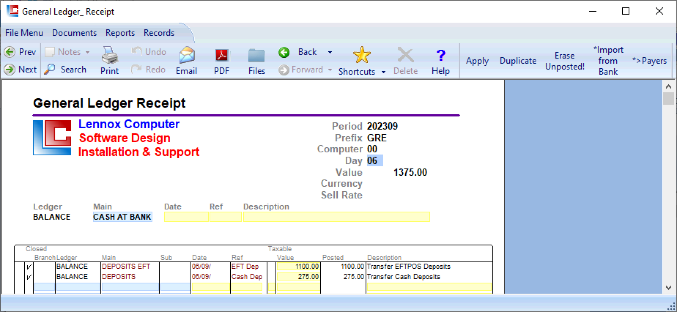

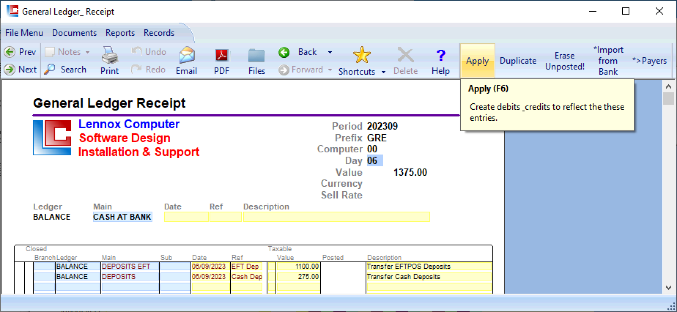

General Ledger Receipt

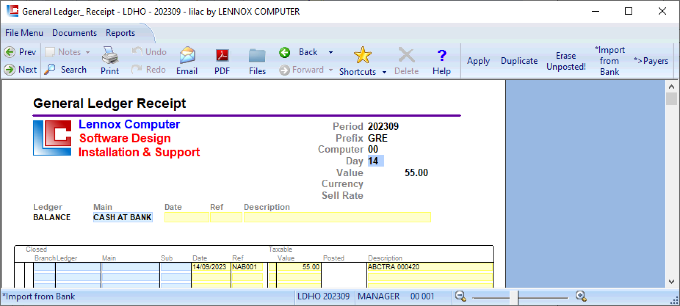

This document is used to record receipt of funds into a business bank account, typically CASH AT BANK.

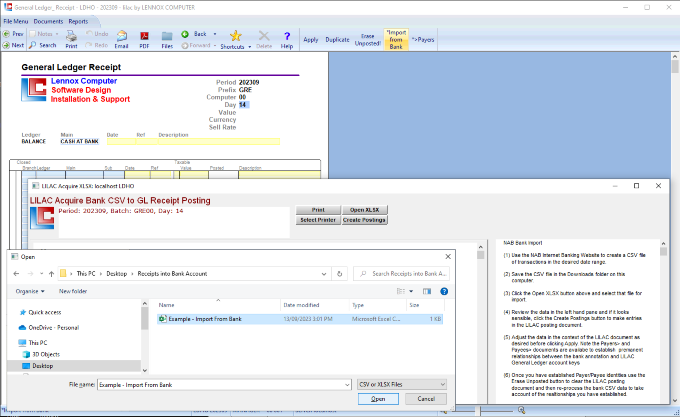

Typically postings are manually entered from a Ledger and Main (Account) reflecting some form of receipt or transfer of funds. '*Import from Bank' is available from the ribbon for bulk imports rather than line by line data entry.

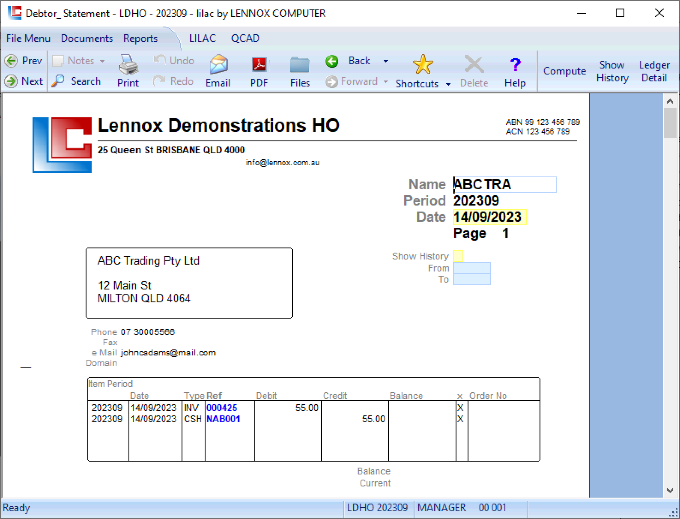

In acknowledging receipt of funds, this document can be used to manually enter Debtor Accounts, or '*Import from Bank' from the ribbon can be used to import multiple lines. Documents > Debtor > Receipt or the 'Matching' button from the Debtor Statement would to be used to distribute the values in this, the General Ledger Receipt document to invoice(s)... matching (marking off) receipt of funds to invoice.

Typically postings are manually entered from a Ledger and Main (Account) reflecting some form of receipt or transfer of funds. '*Import from Bank' is available from the ribbon for bulk imports rather than line by line data entry.

In acknowledging receipt of funds, this document can be used to manually enter Debtor Accounts, or '*Import from Bank' from the ribbon can be used to import multiple lines. Documents > Debtor > Receipt or the 'Matching' button from the Debtor Statement would to be used to distribute the values in this, the General Ledger Receipt document to invoice(s)... matching (marking off) receipt of funds to invoice.

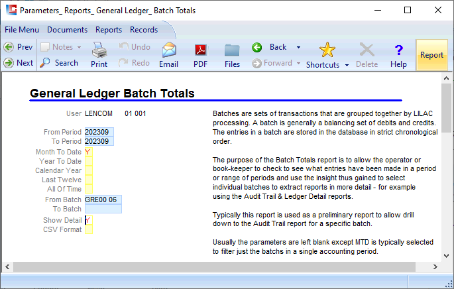

Day

The Day field is required and forms part of the Batch Key for the document. It must be two characters.

For reporting purposes the User will enter the day of the month ie 01 - 31, or the initials of the User.

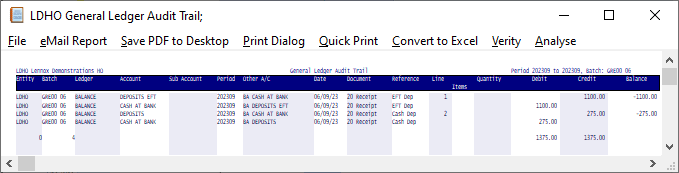

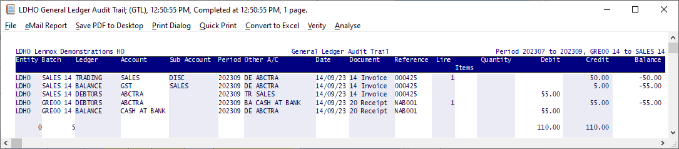

Reports > General Ledger > Audit Trail: Month To Date

Reports > General Ledger > Batch Totals: Month To Date

...each restrict reporting to Batch Keys.

For reporting purposes the User will enter the day of the month ie 01 - 31, or the initials of the User.

Reports > General Ledger > Audit Trail: Month To Date

Reports > General Ledger > Batch Totals: Month To Date

...each restrict reporting to Batch Keys.

To Account:

A debit will be posted to the indicated bank account. In this example Main (CASH AT BANK). Provision is made for Date, Ref, Description.

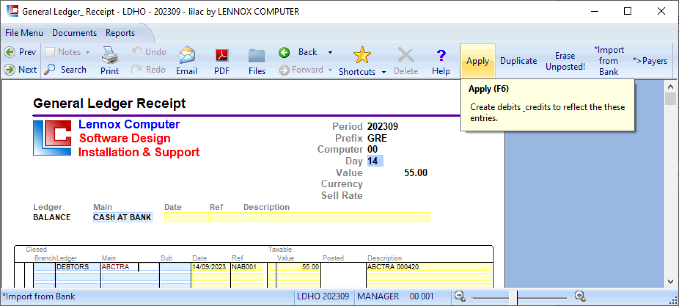

'Apply'

Click 'Apply' to post Ledger Entries.

From Account:

Select Ledger, Main (Account).

Enter a Date, Ref, Value, Description.

A tick in the Taxable column will generate a GST posting.

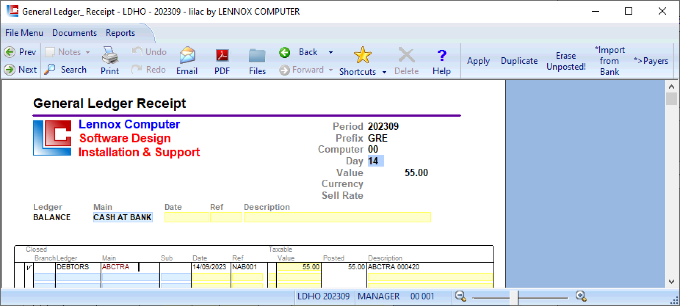

After clicking the 'Apply' button from the ribbon, each line of entry will typically cause the posting of a credit to the indicated Main (Account) and a debit to BALANCE : CASH AT BANK.

More than one line of entries may exist. An accumulating debit is posted to BALANCE: CASH AT BANK.

Enter a Date, Ref, Value, Description.

A tick in the Taxable column will generate a GST posting.

After clicking the 'Apply' button from the ribbon, each line of entry will typically cause the posting of a credit to the indicated Main (Account) and a debit to BALANCE : CASH AT BANK.

More than one line of entries may exist. An accumulating debit is posted to BALANCE: CASH AT BANK.

In this example 'Apply' will post funds from:

BALANCE : DEPOSITS EFT (EFTPOS Debtor Receipts) -> BALANCE : CASH AT BANK

BALANCE : DEPOSITS (Cash received from Debtors) -> BALANCE : CASH AT BANK

BALANCE : DEPOSITS EFT (EFTPOS Debtor Receipts) -> BALANCE : CASH AT BANK

BALANCE : DEPOSITS (Cash received from Debtors) -> BALANCE : CASH AT BANK